By | Arvind Jadhav

Massive Crackdown on Anil Ambani Group

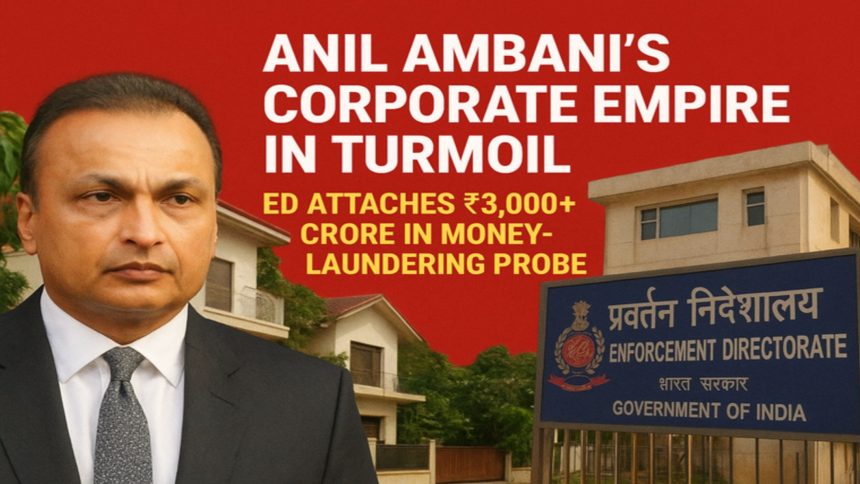

Mumbai: Anil Ambani, chairman of the Reliance Anil Dhirubhai Ambani Group (R-ADA Group), is facing one of the toughest phases of his corporate career as the Enforcement Directorate (ED) intensifies its money-laundering investigation. The probe revolves around alleged financial irregularities and diversion of funds involving Reliance Home Finance Ltd (RHFL) and Reliance Commercial Finance Ltd (RCFL). In a sweeping move, the ED has attached assets worth over ₹3,000 crore across major cities including Mumbai, Delhi, Pune, Chennai, and Noida — marking one of the largest actions against the group to date.

Loan Irregularities and Alleged Fund Diversion

According to ED findings, loans totalling nearly ₹5,000 crore were disbursed by YES Bank between 2017 and 2019 to various Reliance group companies, which later turned non-performing. Investigators suspect that large portions of these funds were diverted through multiple shell entities, with several loan applications, sanctions, and disbursements processed on the same day. Some funds were allegedly released even before formal approvals, indicating possible collusion between bank officials and corporate executives. These transactions have raised major red flags about governance and compliance within the group’s financial operations.

Properties Worth ₹3,000 Crore Attached

The ED has provisionally attached more than 40 properties under the Prevention of Money Laundering Act (PMLA), including Anil Ambani’s iconic Pali Hill residence in Mumbai. The attached assets span commercial land parcels, office spaces, and residential units across multiple cities. Authorities allege that these properties were either acquired using diverted funds or held in the names of associated entities. The ED’s statement suggests that this is “only the first phase” of the crackdown, with further action likely as the investigation expands.

Long History of Financial Distress

This is not the first time Anil Ambani’s business empire has been under regulatory scrutiny. Once seen as a key player in India’s corporate elite, the R-ADA Group suffered a steady decline following heavy debt accumulation and the collapse of Reliance Communications. The current ED probe, however, goes beyond financial failure — it delves into potential criminal violations related to money laundering and misuse of loans. The case underscores how once-dominant conglomerates can face systemic collapse when debt, mismanagement, and weak governance converge.

Reliance Group Denies Allegations

Responding to the ED’s actions, the Reliance Group issued statements denying wrongdoing and labelling the reports “distorted and misleading.” The group claims that Anil Ambani has not held board positions in some implicated entities for years, and that current operations continue normally. Despite these assertions, market analysts believe that the ongoing investigation could damage investor confidence, disrupt funding prospects, and further strain the group’s already fragile balance sheet.

Wider Crackdown on Corporate Money Laundering

The Ambani case is part of a broader enforcement effort targeting corporate loan frauds and banking irregularities. Officials claim that Reliance group companies employed complex fund-routing mechanisms, including round-tripping through related entities, to obscure the source and end-use of money. Such layered transactions, according to investigators, were deliberately designed to evade detection and regulatory scrutiny. The ED’s ongoing forensic audit aims to trace the entire money trail and recover any assets acquired from alleged illegal gains.

Further Possibility

The ED has hinted that more seizures could follow as the investigation widens. Legal proceedings under the PMLA and other banking fraud statutes are expected to intensify, potentially leading to criminal prosecutions. Financial experts believe the outcome will have long-term implications for India’s corporate governance standards and promoter accountability. With regulatory scrutiny deepening and lenders exercising caution, Anil Ambani’s group faces an uphill battle to restore its reputation and stabilize operations.

Corporate Eyes On Investigation

The ED’s investigation into Anil Ambani’s Reliance Group represents far more than a routine enforcement case — it’s a test of India’s corporate transparency and regulatory enforcement. Once hailed as one of the most influential figures in Indian business, Ambani now faces a defining challenge that could determine the legacy of his empire. Whether the group can withstand this unprecedented financial and legal storm remains to be seen.